While Senovo has historically been focused on the DACH market, we have been increasingly looking at attractive B2B SaaS investment opportunities in other European countries during the last two years (like our investments into IamIP (Sweden) and Manta (Czech Republic)). As we are proactively expanding our geographic reach, Krystyna Liakh and I dove a bit deeper into the Spanish ecosystem. We talked to 20+ Spanish experts (angel investors, accelerators, venture funds, universities) and gained very interesting insights into this thriving start-up ecosystem.

Here’s what we learned from a B2B SaaS investor’s perspective and why we think Spain is a great place to be — for both founders and investors:

1. Spain has a thriving start-up ecosystem that benefits from favourable domestic economic conditions, a strong educational system and an advantageous position between Europe and LatAm

Spain is widely recognized as a significant and growing ecosystem, with Madrid and Barcelona consistently ranked in the Top 10 of European start-up hubs. Why is that? We identified five main drivers for thriving entrepreneurship in Spain:

- Tech skills and labour cost: strong technical education and low developer salaries compared to other start-up hubs.

- High capital efficiency: past lack of capital due to a still developing ecosystem has led to high capital efficiency among Spanish entrepreneurs.

- Unemployment: lower opportunity cost due to lack of attractive employment prospects in the corporate sector.

- Digital transformation of domestic corporates: growing domestic market and gradual adoption of new technologies.

- Gateway to EU and LatAm: strong trade ties to EU and cultural ties to LatAm make Spain attractive as a launchpad for inter-continental expansion.

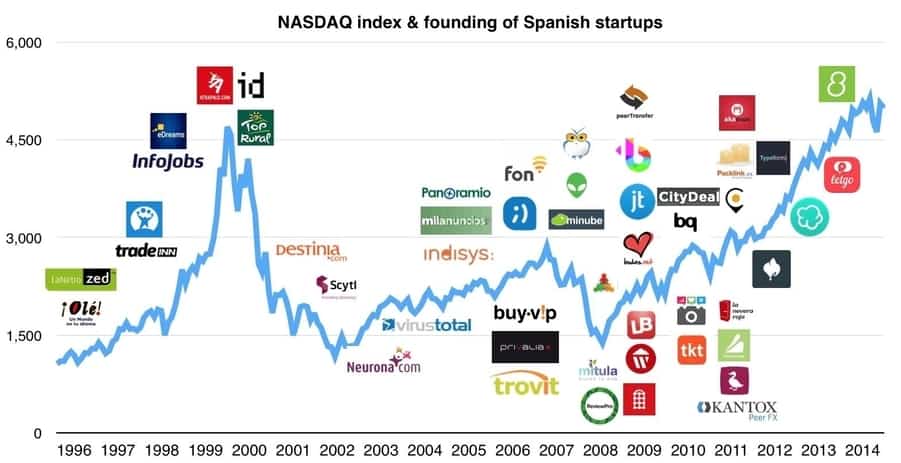

2. Spanish entrepreneurs are moving away from “copycats” towards truly innovative technologies that can be scaled internationally

Based on the total size of venture capital investment, as well venture capital investment per capita, the Spanish ecosystem is still less mature than other European hotspots, namely UK, France, Sweden and Germany. Limited global and technological ambition have held back start-up quality in the past:

- “Size trap”: as founders deem the Spanish market large enough, many have lacked internationalisation ambition, which led to smaller companies and smaller exits (history dominated by below EUR 100MM exits).

- Copycat tendency: copying successful international rivals had been a historically popular approach in Spain. It acted as a barrier to internationalisation and “real” innovation.

- Lack of local role models need for second-time entrepreneurs and experienced senior talent: As our friends from K Fund mapped out (Link), we have seen exits growing in quantity and size but still small compared to more established markets. Spanish entrepreneurs need larger local exits to thrive for and the talent it brings to the ecosystem (especially in B2B SaaS).

- Lack of Capital: Locally available capital has been limited in the past and still remains a challenge in later rounds.

The good news is that all the above is currently changing. First, today we see that Spanish entrepreneurs have a more international mindset and are increasingly focused on true technological innovation. Second, recent local success stories, such as Glovo, Cabify and Spotahome, further fuel that shift with strong local role models and talent. Lastly, local VCs are raising larger funds and foreign investors are increasingly investing in Spain.

“We see a good evolution in the B2B SaaS space, moving from copycats to disruptive innovation. There are more and more founders with the technical talents, strength and experience to deliver this disruption.”

“Given the amount of venture capital that has gone into the market in last 5 years, expect the number of exits to surge in coming years.”

3. With Madrid and Barcelona Spain has two equally strong start-up hotspots

Madrid and Barcelona appear to be of relatively equal importance as venture hotspots in Spain, based on deal numbers and volume (especially when normalising outliers). Our interviews confirmed that the start-up ecosystem is pan-Spanish, with venture capital funds seeing the same deals regardless of their choice of HQ city.

Historically, Barcelona has been the primary Spanish start-up-hub, however Madrid has been catching up in importance. Madrid’s growth is driven by access to corporate headquarters, as well as the uncertainty around Catalonian independence, while Barcelona remains more attractive to founders and international talent due to its more diverse culture and geographic location by the sea.

Regional hubs such as Valencia, Malaga and Bilbao are emerging around engineering schools, but start-ups maintain close relationships to the two hubs (with regard to talent, funding etc.).

“Coverage does work both ways. You see the same deals, if you are in Madrid or Barcelona.”

4. Spain’s start-ups range across industries and business models without any dominating sectors yet. B2B SaaS is on the rise

Spanish start-up activity is distributed across various sectors and business models, without a clear identifiable leader yet. This is mirrored inactivity of local venture capital players: most funds position themselves as generalists, with an opportunistic approach to sector and business model allocation. That said, Jaime’s analysis shows that there has been a trend in the ecosystem towards more B2B models, from a prevalence of B2C businesses in the past (Link): in 2014, B2C deal numbers were 2x B2B; by 2017 this split was equal and interviews confirm that it continues to shift towards B2B, with SaaS vendors playing an important role.

Local VCs note an increasing number of attractive investment opportunities in the B2B SaaS space. Based on a comparison of Crunchbase data for Spain, UK, France, and Germany, we can also conclude that Spain, while still the smallest in absolute terms, experienced the fastest growth in number of B2B SaaS deals per annum, mainly driven by early stage rounds (seed and Series A).

“In terms of sectors, there is no particular stand out performer.”

“Up to now, Spain has not produced a big software company. Market still needs to prove itself…Now to 5 years from now, we expect a B2B SaaS explosion.”

5. Spanish start-ups can expect increased venture funding from both local and foreign investors. Whereby local VCs focus on early stage opportunities, EUR 5+MM rounds will be largely covered by foreign funds

We have seen the total amount of venture investment in Spain growing over the past years, both from local and foreign funds. More than 50% of the local VCs we talked to have either raised a new fund in 2019 or are currently raising a new fund.

Today foreign capital accounts for 50–60% of total venture capital investment in Spain. There was strong consensus from local VCs that involvement of foreign VCs usually takes place at later rounds, from EUR 5MM in round size onwards. This is motivated by persisting capital constraint of local VCs who lack size to lead larger rounds (with exceptions, e.g. Seaya Ventures).

While increased inflow of venture capital has led to rising round sizes, they still remain below European peers. Yet local VCs note higher valuations for attractive investment opportunities (especially in B2B SaaS), which are more comparable to other European countries (especially in Series B rounds where foreign VCs become involved).

Founders with foreign investors in later rounds can benefit from their international network, operational support for expansion and added credibility through their international brand.

“As fund sizes grow and more investment flows in, valuations will increase.”

“We speak with foreign VCs because we need to find Series A investors for our companies.”

As you can see, beyond great food, wine and beaches, there are a number of good reasons to start a business in Spain or to visit as an investor.